U.S. National Healthcare Landscape

The U.S. has higher rates of medical, medication and lab errors than comparable countries, and it might not be surprising that patients in the U.S. have much shorter average hospital stays among the 5,686 registered U.S. hospitals. These annual hospital stays cost $859.4 billion, supported by only 914,513 beds and revolving admissions among 35.4 million patients. In short,

the U.S is providing some of the worst quality of care, and we as patients are paying the more for it.

There must be a better way.

The urgency of the U.S. health policy discussions is led by the fear that national health expenditures (NHE) have grown to 7% of the nation’s economy (gross domestic product, or GDP) and may soon inch past 8% of national GDP. The nation has targeted access, price, and quality as essential obstacles to pushing down the rampant annual increase in healthcare expenditures. The introduction of healthcare reform has reinforced that quality does not improve with more controls and that cost controls actually increase costs. Quality of care will not become a priority if doctors, hospital administrations and insurances companies are drowning in paperwork.

Employee Engagement Increases

The public won’t tolerate annual healthcare price hikes. In response employers are shifting the burden onto working families. Work force mobility helped build the case for private sector pensions to shift investments risk from the corporate sector to households; healthcare is experiencing a similar shift today. While finance and accounting reform set the climate for the change with pensions from defined benefits to defined contributions, healthcare reform is setting a similar stage opening opportunities for companies to transfer risk to individuals while shaving benefits.

However, defined benefits won’t lose to a pure breed of defined contribution approaches where employers give workers a handful of cash to purchase health insurance totally on their own.

The future of healthcare defined contributions will be a hybrid approach.

Ezekiel Emanuel, in his recent book ‘Reinventing American Health Care’ suggested that “the proportion of private-sector-workers with employer-sponsored insurance by January 1, 2025 will be less than 20% (p.296).” This trend isn’t about to start, it has already started.

Defined contributions need a marketplace for workers to select health insurance in order to be successful. This helps crack open the private exchange market. Second employer benefits of expense management (predictable employee health benefit costs), administration time savings (setup simplicity and decrease necessity of employer resources), and enhanced employee choice (selecting plans and preferred networks) are going to lean employers toward private health exchanges. Third in the technology-rich environment of today this trend is a logical extension of the consumer-directed health care plans such as a health savings accounts (HSA) or flexible spending accounts (FSA).

The trend of employee choice has extended past simple HSA and FSA accounts, it has put wearables into the hands of consumers.

Wellness Pays

The global wellness industry is a $3.4 trillion market, or 3.4 times larger than the worldwide pharmaceutical industry. This opens huge financial opportunities for companies. However, we must approach the cost justification for wellness differently. Conventional financial indicators and measures of profitability include return on equity (ROE) and return on total assets (ROA) aren’t effective to measure wellness return on investments (ROI). Only net profit margin is an effective measure for wellness financial returns.

Direct sources of revenue from health and wellness programs typically contributing to net profit margin are weak and bring in sponsorship contributions, customer costs or fee for service models, and advertising revenue. That’s not where the real financial value is located. That is not where your company, your employees or your consumers will benefit the most.

The real value drivers of health and wellness programs stem from patient Rx compliance, customer loyalty, consumer engagement, and innovation competitiveness.

Your competition is already aggressively searching for these value drivers.

Competitors Search for Innovation

Exploring health and wellness programs of the past don’t work. They engage people that are already engaged. The key is discovering how we engage the unreachable. Better health equals greater engagement. Growth in engagement, productivity (absenteeism, presence of mind), and loyalty builds a positive brand and a culture that attracts healthier employees and healthier members. The level of engagement from a Fitbit, Nike FuelBand, and Moto 360 that tracks nutrition intake, active calorie burn, sleep patterns, daily steps, among other health and well being metrics is hard to quantify.

Measuring healthier, happier, and more engaged employees, is just plain tough.

It might be easier to measure the cost of doing nothing, when our competitors are doing something.

It used to be simple, we compete on price. It’s simple really, we keep costs down and we’re competitive right? Today that’s no longer good enough to grow a business or build 10x margins. We have to go beyond price to exchange. With exchange a consumer gives you their attention for engagement and thus our company value is now created (enhanced network effect). Price has become exchange, the value of the experience.

Value is created through experience.

Price still matters but it matters less. Healthier employees and members all depends on increasing engagement.

Encouraging consumers to participate through health and wellness programs builds engagement. Through engagement an interactive experience can open, which draws on consumer analytics, and begins the conversation about working for a healthier tomorrow.

References

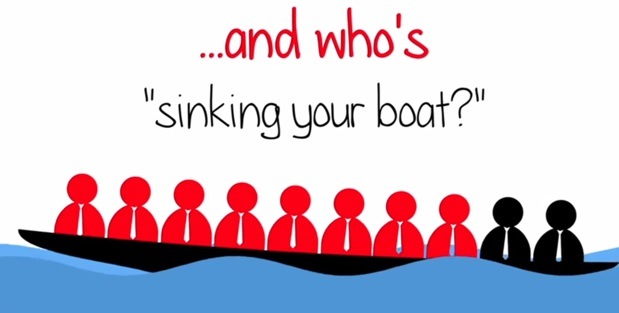

Kelleher, B. (2013). Employee Engagement – Who’s Sinking Your Boat? (Online Image). Retrieved September 22, 2015, from https://www.youtube.com/watch?v=y4nwoZ02AJM

Peter Nichol, empowers organizations to think different for different results. You can follow Peter on Twitter or on his blog. Peter can be reached at pnichol [dot] spamarrest.com.